Remote work is changing the way businesses hire and manage talent.

The ability to access a vast pool of professionals offers significant advantages, but it also poses the challenge of how to pay remote candidates across borders.

In the current remote work scenario, traditional payment methods are often unsuitable due to their slow, expensive, and administratively burdensome nature, which can pose a challenge for HR and payroll teams.

Therefore, businesses are looking for alternative payment solutions better suited to the needs of a global workforce.

This blog explores seven payment methods that can help streamline your payroll process for remote candidates.

PayPal

In 1998, PayPal was established as an online payment platform. It has become the most widely used payment platform worldwide, especially among small businesses.

PayPal offers a range of features, such as accepting customer payments, managing invoices, customizing check-out pages, and creating multiple online stores.

Features and Benefits:

- Global Acceptance: PayPal is widely recognized internationally as one of the most reliable and frequently used platforms.

- Ease of Integration: Easily integrates with various e-commerce platforms.

- Versatile Payment Options: Supports diverse payment methods like credit cards, bank transfers, and PayPal Credit.

- Enhanced Security: Utilizes end-to-end encryption and fraud monitoring.

- Global Reach with Currency Support: Facilitates international transactions with multi-currency support.

- Invoicing and Recurring Payments: Simplifies invoicing and manages subscriptions effectively.

- Seller Protection: Provides safeguards against unauthorized transactions and disputes.

- Insightful Analytics: Delivers valuable transaction history and sales reports.

Cons:

- Fees: Transaction fees, including a percentage of the transaction amount plus a fixed fee, can accumulate, impacting profitability.

- Limited Customer Support: Difficulties in obtaining timely and satisfactory customer support.

- Hold and Reserve Policies: Can tie up funds needed for immediate operational expenses.

- Account Freezes and Restrictions: Account limitations in cases of suspected fraudulent activity or policy violations.

- Chargebacks and Disputes: Buyer protection policies can lead to disputes that disadvantage businesses.

Is PayPal Right to Pay Remote Candidates?

The suitability of PayPal for your business depends on your needs and concerns.

If you are searching for a convenient and widely used payment solution to pay remote candidates across the globe, PayPal could be a suitable option for you.

However, if you are concerned about transaction fees or the risk of chargebacks, exploring other payment solutions that better match your remote hiring needs may be worthwhile.

Payoneer

Payoneer is an online financial services brand that was founded in 2005. It is mainly popular among small businesses and has established itself as a pivotal player in the industry.

Payoneer, based in New York, provides a platform for domestic and international transfers, digital payments, and working capital. It supports over 200 countries and 150 currencies worldwide.

Features and Benefits:

- Global Reach and Currency Support: Payoneer supports transactions in major currencies like USD, EUR, GBP, CAD, AUD, JPY, and CNH, catering to a broad international audience.

- Receiving and Sending Payments: Businesses can accept payments via credit card, ACH direct deposit, or Payoneer accounts and send funds using various methods, including bank transfers and credit cards.

- Multi-Currency Accounts: Companies can open local currency accounts in numerous regions, facilitating easier currency management and transfers.

- Working Capital Options: Payoneer offers merchant cash advances up to $750,000 for sellers on platforms like Amazon and Walmart.

- Ease of Withdrawal: With a fixed fee structure for Payoneer Mastercard users, users can withdraw money from any ATM worldwide.

- Batch Payments: Facilitates batch payments to up to 200 bank accounts simultaneously, with a reasonable fee structure.

Cons:

- Annual Account Maintenance Fee: Payoneer charges an annual fee of $29.95 after 12 months of inactivity.

- Currency Conversion Fees: A 2% to 2.75% conversion charge applies for international transactions.

- Withdrawal and Transaction Fees: Fees for withdrawals and specific transactions may apply, impacting overall cost-efficiency.

- Lengthy Signup Process: Some users report a protracted process with extensive paperwork for account setup.

Is Payoneer Right to Pay Remote Candidates?

Payoneer offers an all-inclusive solution if you are involved in global e-commerce or need a versatile platform for receiving and sending payments internationally.

However, if you are concerned about fees associated with currency conversions and transactions, explore other options that better align with your financial strategy.

TransferWise (Now Known as Wise)

TransferWise, rebranded as Wise, was established in 2011 in the UK by Kristo Käärmann and Taavet Hinrikus, Estonians.

The platform is renowned for its affordable fees on international transfers and currency conversions, making it a favored option for businesses that engage in foreign transactions with remote workers.

Features and Benefits:

- Low International Transaction Fees: Wise is celebrated for its minimal fees, a significant advantage over traditional bank fees.

- User-Friendly Platform: Creating an account is straightforward, and users can manage transfers via the Wise app on various devices.

- Peer-to-Peer Money Transfer: This unique transfer method offers Wise lower fees than traditional services.

- Currency Exchange at Mid-Market Rates: Wise uses the mid-market rate for currency exchanges, ensuring fair conversion rates without additional fees.

- Support for Multiple Currencies: Wise supports 31 currencies and over 300 currency routes, accommodating a wide range of international transactions.

Cons:

- Lack of Mass Payment Options: Currently, Wise doesn’t offer a system for automated mass payments, which may limit its utility for some businesses.

- Not Suitable for E-commerce: Wise is not designed for e-commerce purposes, focusing on individual and business money transfers.

Is TransferWise (Wise) Right to Pay Remote Candidates?

Wise is a cost-effective option for businesses dealing with international transactions. It offers low fees and mid-market currency exchange rates.

However, Wise may not be best if your business needs a mass payment system or specific e-commerce functionalities.

OnTop

OnTop is a comprehensive payroll and HR solution designed to assist companies in managing and paying their international teams across over 150 countries.

It integrates built-in financial services to facilitate global scaling for businesses.

Features and Benefits:

- Global Hiring Capability: OnTop supports legal operations in more than 150 countries, making it an efficient tool for global talent acquisition.

- Swift Global Contractor Management: The platform enables the drafting and finalizing of intelligent contracts within 5 minutes.

- Seamless Global Compliance: OnTop ensures compliance with legal documentation in various jurisdictions.

- Instant Worldwide Payments: Offers a one-click solution for paying entire teams, streamlining the payment process.

- Financial Empowerment for Teams: Provides a dollar-backed wallet and a digital Visa card for real-time spending, enhancing financial flexibility.

- Subscription Plan: The Wanderlust Membership at $12.9/month includes benefits like 5% cashback on purchases with the OnTop card and contactless payment options.

Cons:

- Software Access and Support Issues: Some users have experienced difficulties with software access and customer support.

- Mandatory Use of Virtual Wallet: Contractors are required to be paid via the OnTop virtual wallet.

- Limited HR Tools: OnTop offers fewer HR tools than other payroll software.

- Currency Exchange Fluctuations: Using the OnTop Wallet might lead to discrepancies due to exchange rate variations.

Is OnTop Right to Pay Remote Candidates?

OnTop simplifies global workforce management and payments, ensuring fast contract compliance for remote hires.

However, if your business requires advanced HR tools and extensive software integrations or prefers more traditional payment methods, OnTop might not fully meet your needs.

Deel

Deel is a platform that simplifies managing and paying international teams. It provides a range of services, including global payroll, contractor management, and employee-of-record services, making it a comprehensive solution for businesses that hire remote candidates.

Features and Benefits:

- Global Hiring and Operation: Deel allows businesses to operate legally in over 150 countries, facilitating international workforce management.

- Compliance Management: Ensures all necessary legal documentation is handled, maintaining compliance across different jurisdictions.

- Instant Payments: Provides a one-click solution for paying entire teams globally, enhancing payment efficiency.

- Financial Tools: Equips teams with a dollar-backed wallet and a digital Visa card for immediate spending, offering financial flexibility.

- Employee of Record Services: Available in more than 100 countries, starting at $599 monthly, enabling businesses to manage international employees easily.

Cons:

- Lack of Time Tracking Tools: Deel does not offer built-in tools for time tracking.

- Potential High Cost: The per-worker pricing structure might lead to higher costs, especially for larger teams.

Is Deel Right to Pay Remote Candidates?

Deel offers a comprehensive solution for global payroll and HR needs, with top-notch compliance and legal document services, making it a go-to choice for businesses expanding worldwide.

However, it may not be ideal for businesses as it may come with higher costs.

Stripe

Stripe, founded in 2011, is a trusted payment processing and merchant services company.

With an A+ rating from the Better Business Bureau, Stripe offers a global payment system that accepts over 135 currencies, making it a popular choice for businesses hiring remotely.

Features and Benefits:

- Global Payment System: Accepts more than 135 currencies, accommodating a diverse customer base.

- Instant Account Approval: Most merchants can start processing payments immediately, which benefits startups.

- Diverse Payment Methods: Supports universal payment types like Alipay, Apple Pay, Google Pay, and various local payment methods.

- Financial Reporting: Provides real-time information and financial reporting with Stripe Sigma.

- Subscription Management: Enables easy setup and management of subscriptions and recurring payments.

- Stripe Atlas and Connect: Offers tools for starting a US-based startup and simplifies payment processes for marketplaces.

Cons:

- Geographical Limitations: Stripe is available in 44 countries, with some features not accessible in certain regions.

- Developer Requirement for Customization: Customizing Stripe’s API may require technical expertise or hiring a developer.

Is Stripe Right to Pay Remote Candidates?

Stripe is a popular payment processor for businesses due to its user-friendly platform, transparent pricing, and global reach, making it ideal for companies with remote employees.

However, if your business operates outside of Stripe’s supported countries or requires specialized payment features, you may need to consider alternative options.

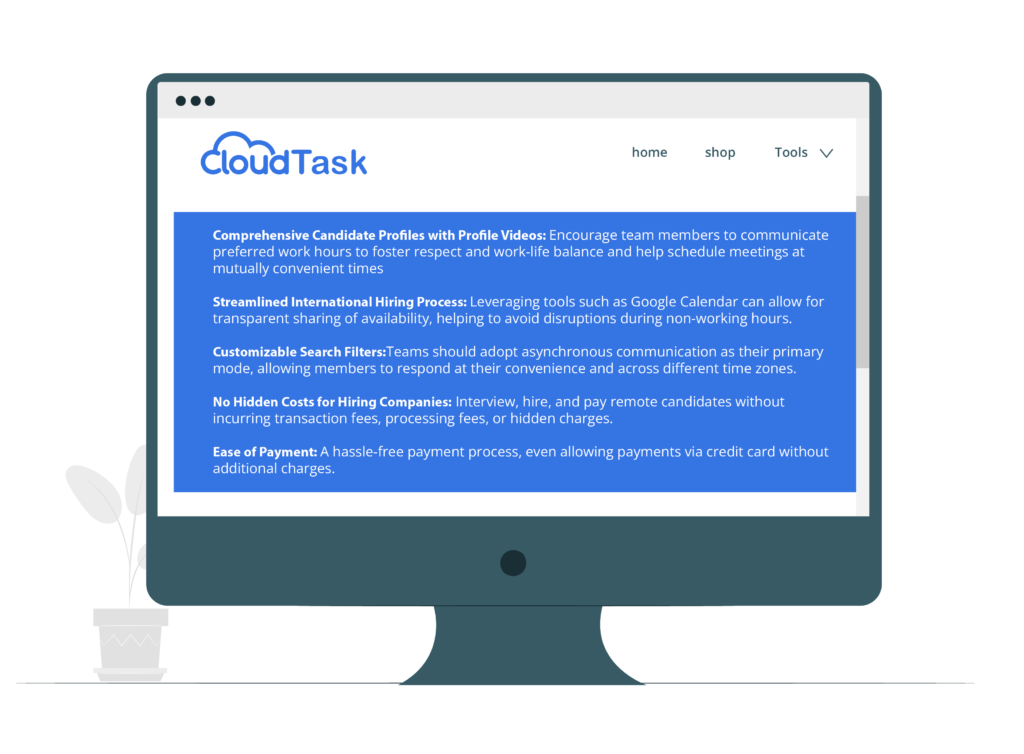

CloudTask Marketplace: Your Best Solution to Hire and Pay Remote Candidates

Many businesses find it necessary to source remote talent for RevOps roles in an increasingly globalized market.

The CloudTask Marketplace stands out as an innovative platform tailored to streamline hiring remote sales professionals for RevOps positions.

It is handy for businesses targeting the LATAM region as it offers the convenience of time zone alignment with the United States.

Features and Benefits:

CloudTask Marketplace is the perfect solution for businesses looking to optimize their remote sales teams.

With a user-friendly platform and simplified hiring and payment processes, you can quickly and effectively build a remote workforce tailored to your business needs.