Searching for the best lead generation strategies for financial advisors, you landed in the right place.

Without a steady flow of qualified leads for financial advisors, meeting your growth objectives can be difficult, and your practice may eventually come to a standstill.

As consumers become increasingly cautious of unsolicited outreach, traditional lead generation methods like cold calling and direct mail are proving to be less effective.

But no worries, we have put together a list of 13 effective lead generation strategies that can help you overcome these challenges and take your financial advisory practice to new heights.

1. Partnering with a Lead Generation Agency

Working in collaboration with specialized financial advisor lead generation companies can prove to be a game-changer for financial advisors who are looking to secure high-quality financial advisor leads on a consistent basis.

These agencies possess the expertise, resources, and tools required to target the right audience and deliver qualified leads for financial advisors directly to your doorstep.

Benefits of partnering with a financial advisor lead generation service include:

A lead generation agency like VSA Prospecting can help financial advisors achieve significant growth by providing the best financial advisor leads and working closely with the client to ensure campaign success.

For instance, Michelle Plunkett, Senior Vice President of Strategic Partnerships, shared a story about a financial advisory firm that partnered with VSA Prospecting and experienced a 50% increase in qualified leads for financial advisors within the first three months, resulting in a 20% growth in revenue by the end of the year.

2. Refreshing Cold Calling Tactics

Although cold calling may seem like an old-fashioned strategy for generating financial advice leads, it can still be highly effective if done using modern techniques and reliable contact databases.

By using targeted lead lists for financial advisors and phone-verified mobile numbers, financial advisors can significantly improve their connection rates and engage with potential clients on a more personal level.

Tips for successful cold calling:

- Use a verified, up-to-date contact database to ensure you’re reaching the right people.

- Craft a compelling script that focuses on the value you offer, rather than just pitching your services.

- Practice active listening and ask open-ended questions to uncover the prospect’s needs and pain points.

- Follow up promptly with additional resources or information based on the conversation.

- Track your results and continuously refine your approach based on what works best.

Ricky Pearl from Pointer Strategy shared a success story where one of their clients gave them a list of just 40 accounts to break into.

Within six months, Pointer Strategy was able to secure meetings with C-level executives from 20 of those accounts, demonstrating the power of effective cold-calling tactics for generating leads for financial advisers.

3. Lead Generation Strategies For Financial Advisors Utilizing Buyer Intent Data

Intent data is a valuable source of information that offers insights into the online behavior of potential clients.

Financial advisors can leverage data to identify financial planner leads who are actively researching financial services.

This analysis can help them determine the best time to reach out to these prospects and initiate a sales conversation when they are most open to it.

How to leverage intent data for lead generation for financial advisors:

- Partner with a reputable intent data provider to access high-quality, actionable insights.

- Identify key topics and keywords related to your services, such as “retirement planning” or “wealth management”.

- Monitor intent data signals to spot prospects who are actively engaging with content related to these topics.

- Craft personalized outreach messages that speak directly to the prospect’s interests and pain points.

- Use intent data to prioritize your lead list and focus your efforts on the most promising opportunities.

4. Effective Email Marketing Campaigns

Crafting targeted email campaigns is another powerful lead generation strategy for financial advisors.

By segmenting your email list and delivering personalized content that addresses the unique needs and concerns of each group, you can capture the interest of potential clients and nurture them through the sales funnel.

Best practices for effective email marketing:

- Segment your email list based on factors such as age, income level, and financial goals.

- Develop a consistent email schedule to keep your practice top-of-mind.

- Use compelling subject lines and preview text to increase open rates.

- Provide valuable, educational content that demonstrates your expertise and builds trust.

- Include clear calls to action that encourage recipients to take the next step, such as scheduling a consultation or downloading a resource.

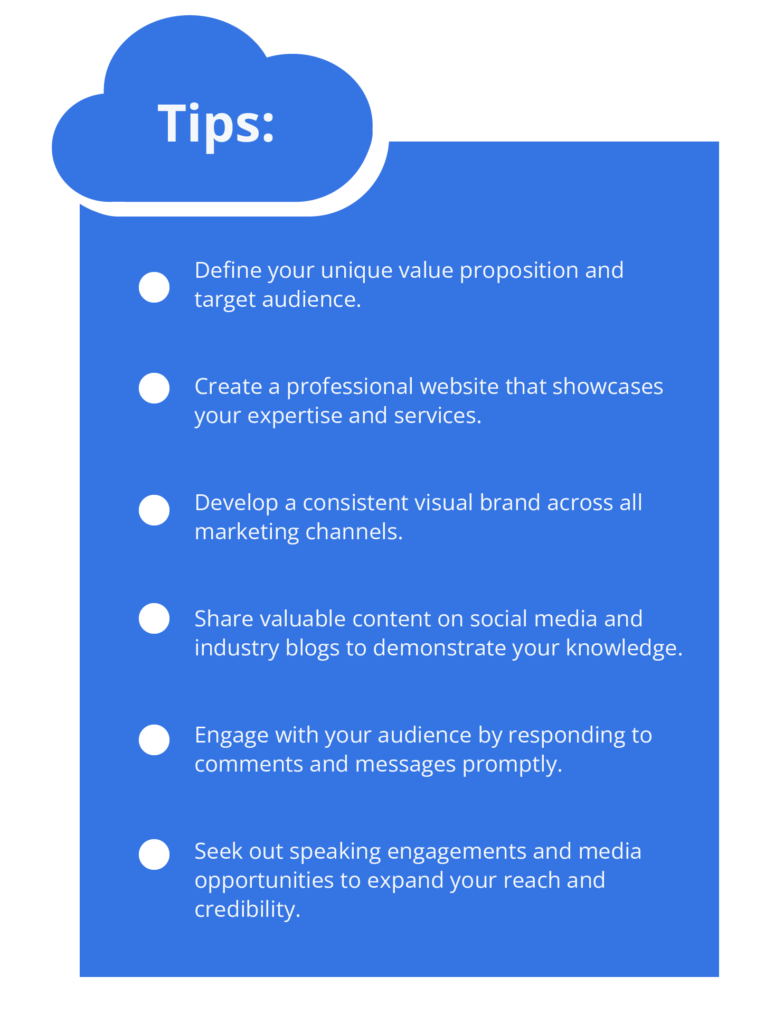

5. Building Your Personal Brand as a Financial Advisor

Establishing trust and authority through personal branding is crucial for attracting financial planning leads and building long-lasting client relationships.

By positioning yourself as a thought leader and expert in your niche, you can differentiate yourself from competitors and attract potential clients who seek reliable financial guidance.

Tips for building a strong personal brand:

LinkedIn can be an effective tool for increasing your personal exposure and connecting with your desired audience.

Through sharing useful content, joining pertinent conversations, and highlighting your skills, you can establish a powerful personal brand that connects with financial adviser leads.

6. Gleaning Insights from Competitors

Studying the strategies of your competitors can be very helpful in understanding how to get leads as a financial advisor.

By keeping an eye on their online presence, marketing campaigns, and client reviews, you can identify areas where you can improve your own approach and differentiate yourself in the market.

Tools and techniques for effective competitive analysis:

- Use tools like SEMrush to analyze your competitors’ top-performing keywords, ad copy, and landing pages.

- Monitor your competitors’ social media profiles to see what type of content resonates with their audience.

- Sign up for your competitors’ email newsletters to stay informed about their marketing strategies.

- Read customer reviews and testimonials to identify your competitors’ strengths and weaknesses.

7. Creating Strategic Partnerships

Collaborating with professionals from different fields, such as lawyers and accountants, can help you discover fresh opportunities for generating leads for financial advisers.

Building a strategic partnership with them allows you to access each other’s networks and share leads, creating a mutually beneficial situation.

Tips for initiating and maintaining strategic partnerships:

- Identify professionals who serve a similar target audience but offer complementary services.

- Reach out with a personalized message expressing your interest in collaborating.

- Set up a meeting to discuss your respective services and how you can support each other’s growth.

- Establish clear guidelines for lead sharing and referrals to ensure a fair and mutually beneficial partnership.

- Maintain regular communication and look for opportunities to cross-promote each other’s services.

8. Mastering SEO Techniques

Financial advisors who aim to target a specific geographical area must master local SEO to dominate search results and attract nearby financial adviser leads.

Optimizing your online presence for local search can make it easier for potential clients in your area to find and get in touch with your practice.

Practical steps for enhancing local visibility online:

- Claim and optimize your Google My Business profile, ensuring that your business information is accurate and up-to-date.

- Encourage satisfied clients to leave reviews on your Google My Business profile and other relevant directories.

- Optimize your website for local keywords, such as “financial advisor in [your city]”.

- Build local citations by listing your practice on online directories and industry-specific websites.

- Create localized content that addresses the unique financial challenges and opportunities in your area.

9. Sharing Free, High-Quality Content

Although gated content can be a useful lead magnet, some professionals believe that sharing valuable resources for free can be more effective for generating free leads for financial advisors.

This is because when you offer top-notch content without requesting an email address or other personal information, you exhibit your expertise and establish credibility with potential customers.

Benefits of sharing ungated content:

- Attracts a wider audience and increases brand awareness.

- Demonstrates your commitment to providing value and educating your target market.

- Builds trust and credibility by showcasing your expertise without asking for anything in return.

- Encourages social sharing and backlinks, which can improve your search rankings and drive more traffic to your website.

- Allows potential clients to engage with your content and get to know your brand before making a commitment.

10. Using Social Media Ads for Targeted Lead Capture

Social media platforms like Facebook offer powerful advertising tools that enable financial advisors to reach their ideal clients with targeted ads.

Here are some tips for creating effective social media ad campaigns to generate leads for financial advisers:

- Define your target audience using the platform’s detailed targeting options.

- Create compelling ad copy and visuals that speak directly to your audience’s needs and pain points.

- Use a clear and specific call-to-action that encourages users to take the next step, such as scheduling a consultation or downloading a resource.

- Experiment with different ad formats, such as carousel ads and video ads, to see what resonates best with your audience.

- Monitor your ad performance regularly and adjust your targeting, copy, and visuals as needed to optimize your results.

11. Organizing Webinars and Virtual Events

Financial advisors can leverage webinars and virtual events to showcase their knowledge, inform potential clients, and generate financial advisor leads.

Tips for creating successful webinars and virtual events:

- Choose a topic that addresses a specific pain point or challenge your target audience faces.

- Promote your event through email, social media, and paid advertising to maximize attendance.

- Provide valuable, actionable content demonstrating your expertise and leaving attendees with a clear next step.

- Engage with attendees by encouraging questions and discussion throughout the event.

- Follow up with attendees after the event to continue the conversation and nurture the relationship.

12. Driving Growth with Referral Programs

Referral programs can be a powerful lead generation tool for financial advisors, as they leverage the trust and credibility of existing clients to attract new business.

You can tap into a valuable source of warm leads for financial advisers by incentivizing satisfied clients to refer their friends, family, and colleagues to your practice.

Best practices for designing an effective referral program:

- Offer compelling incentives that motivate clients to refer others, such as gift cards, exclusive events, or discounted services.

- Make it easy for clients to refer others by providing shareable links, referral cards, or a simple online form.

- Communicate the benefits of your referral program clearly and consistently across all client touchpoints.

- Track and analyze your referral program’s performance to identify areas for improvement and optimize your results.

13. Implementing AI-Driven Chatbots

AI-powered chatbots are revolutionizing lead generation for financial advisors at an unprecedented rate.

These chatbots harness the power of artificial intelligence to engage with website visitors in real-time, answer their queries, and guide them toward scheduling an appointment with your business.

The benefits of using AI-driven chatbots for financial advisor lead generation include:

- 24/7 availability: Chatbots can engage with potential leads around the clock, ensuring that no opportunities are missed due to limited business hours.

- Instant response: Visitors receive immediate answers to their questions, improving their experience and increasing the likelihood of conversion.

- Personalized engagement: AI-driven chatbots can tailor their responses based on the visitor’s behavior and inquiries, creating a more personalized and engaging interaction.

- Efficient lead qualification: By asking relevant questions and gathering important information, chatbots can help qualify leads and direct them to the most appropriate next step.

- Scalability: Chatbots can handle multiple conversations simultaneously, allowing your practice to generate and nurture leads on a larger scale.

Cutting-edge AI-powered chatbot platforms, like AnyBiz, are pushing the boundaries of lead generation capabilities.

These innovative technologies offer businesses personalized outreach and relationship-building AI sales agents that can effectively generate best financial advisor leads.

Conclusion

As a financial advisor, staying ahead of the curve when it comes to lead generation is not just important – it’s essential.

In a world where consumer preferences and marketing channels are constantly changing, embracing new strategies and technologies is the key to unlocking sustainable growth for your practice.

Remember, lead generation for financial advisors is not a one-and-done task – it’s an ongoing journey of experimentation, optimization, and growth.

If you’re in search of the best lead generation companies for financial advisors, the CloudTask Marketplace is your go-to resource.

Our platform simplifies finding your ideal financial advisor lead generation service with detailed agency profiles, comprehensive service information, and user-friendly search filters.

Don’t let lead generation challenges hold you back any longer – explore the CloudTask Marketplace today and unlock your potential to generate qualified leads for financial advisors.