Understanding the legal aspects of remote sales work is crucial to reap the benefits of this modern work style.

Remote work is becoming increasingly popular, and it is projected that by 2025, around 22% of the American workforce, or 32.6 million people, will be working remotely.

As the trend towards remote sales work continues to grow, employers face the complex task of navigating the legal considerations of remote work.

Legal compliance is vital when managing a remote sales team. Overlooking legal requirements can lead to legal consequences and liabilities.

This blog simplifies the legal aspects of remote sales work and provides information for employers building a remote sales team.

What Are the Legal Aspects of Remote Sales Work Across International Borders?

Navigating the legal terrain of remote sales work, especially when it transcends international borders, is crucial for maintaining compliance and ensuring successful RevOps.

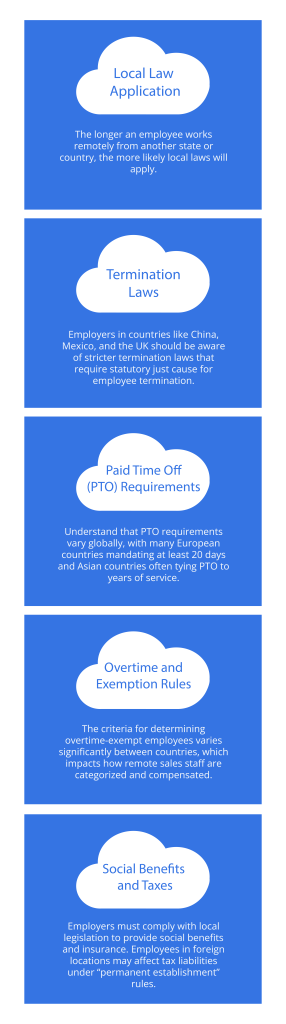

The laws of the state or country where the employee performs services typically govern the employment relationship.

Employment laws in many countries favor employees more than the U.S., often imposing restrictions on an employer’s ability to terminate employment.

Here are some key aspects to keep in mind and recommendations to ensure compliance:

What Are the Tax Rules for Remote Sales Work?

It’s essential to comprehend the tax consequences of hiring sales workers who work remotely to avoid legal problems and unexpected financial issues.

This becomes especially significant when dealing with remote employees based in different countries.

To ensure compliance and simplify the process, we have listed the key tax considerations and suggestions:

- Status Matters (Freelance vs. W-2): Distinguish between freelancers (independent contractors) and employees from the start. Ensure proper documentation for freelancers, such as a 1099 form for annual payments exceeding $600.

- Global Tax Codes: Each country has a unique tax code. For US companies hiring non-US citizens living abroad, these employees typically don’t incur US taxes. However, US citizens working remotely may still need to file tax returns.

- Hiring Internationally: U.S. businesses can only hire workers in other countries by establishing a local legal entity or using an Employer of Record (EOR). Misclassification of employees as independent contractors can lead to significant penalties.

- Independent Contractors Abroad: Contractors outside the U.S. should manage their taxes independently, considering the varying tax rates across countries. Employers generally do not withhold taxes for contractors.

- Limiting Tax Liability: Remote workers should ensure their employment status is clear and comply with local tax laws. If misclassified, they should be reclassified promptly to avoid legal issues.

- Employment through an EOR: Utilizing an EOR can help companies comply with local labor and tax regulations while providing a supportive environment for international employees.

How Do International Employment Contracts Shape Remote Sales Work?

When hiring remote sales workers, partner with an Employer of Record (EOR) to comply with employment laws and reduce risk.

An EOR acts as an intermediary to prevent incorrect tax reporting.

If you choose to hire directly, it is important to consider the following tips when creating hiring contracts for remote sales candidates:

- Remote Worker Classification: Distinguishing between full-time employees and independent contractors is crucial for legal compliance. Misclassification can result in severe penalties and financial liabilities.

- Global Variations in Worker Classification: Each country has unique worker classification rules. For instance, Latin American countries grant equal employment benefits regardless of employment status.

- Developing Employment Contracts: An appropriate employment contract can be drafted after determining a worker’s classification. Depending on local labor laws and work requirements, contracts may include full-time, part-time, or fixed-term.

- Contract Terms and Compliance: Employment contracts are crucial tools that establish expectations and ensure compliance with laws and regulations. They promote trust and transparency, contributing to a positive remote work environment.

- Work Hours and Overtime Pay: Understanding local laws related to work hours and overtime pay is crucial. Ensure that your employment contracts reflect regional differences, such as overtime rates increasing after a certain number of hours in Australia.

- Termination and Severance Policies: Familiarize yourself with local laws on termination and severance. Different regions have varied regulations. Being informed about these differences is key to lawful and respectful employment practices.

How Do Data Security and Privacy Laws Impact Remote Sales Work?

Ensuring the security and privacy of data is of utmost importance for remote sales work, as it safeguards the confidential information of the company and its clients worldwide.

It is essential to understand the meaning of data security, cybersecurity, and data privacy and comply with recommended guidelines.

Here’s an overview of what these entail and key recommendations for compliance:

How to Protect Intellectual Property and Confidentiality?

Preserving intellectual property and maintaining confidentiality is crucial for remote sales. It helps companies maintain their competitive edge and comply with legal regulations.

As defined by the World Intellectual Property Organization (WIPO), intellectual property encompasses inventions, literary and artistic works, commercial symbols, and designs.

Properly managing IP rights in a remote work environment is essential to avoid disputes, protect sensitive information, and safeguard the company’s creative assets.

Here are some key considerations:

- Understanding IP Laws: Utilize resources like WIPO’s online database to understand IP laws in each country where your remote workers operate, ensuring global compliance and protection.

- Defining IP Rights for Remote Work: Establish who owns employee-created IP in remote settings to prevent unauthorized use, legal issues, and loss of company assets.

- IP Clauses in Employment Contracts: Embed specific clauses in employment contracts that cover IP rights and confidentiality. This provides a legal basis for protecting the company’s innovations and proprietary information.

- Regular IP Policy Training: Conduct periodic training and educate remote workers about the company’s IP policies. This reinforces the understanding of ownership, usage permissions, and confidentiality obligations.

Conclusion

Establishing a remote sales team that aligns with legal requirements is crucial for businesses to tap into the vast potential of the modern workforce.

However, navigating international employment laws, tax codes, data protection regulations, and HR policies can be daunting.

This is where CloudTask steps in to simplify the process.

Our talent marketplace connects you with over 500 pre-screened RevOps professionals who can help unlock your business’s full potential.

Our team of experts is committed to simplifying the recruitment and payroll management process for you so that you can focus on driving revenue growth for your company.

Frequently Asked Questions (FAQs)

What are some key legal considerations when hiring remote sales staff?

- Significant factors include local employment laws, tax codes, worker classification, overtime pay requirements, termination policies, and social benefits obligations. Using an Employer of Record (EOR) can simplify compliance.

How can companies protect confidential data and intellectual property with remote sales teams?

- Implement cybersecurity defenses, data encryption, access controls, and comprehensive IP ownership and confidentiality policies. Provide regular training to reinforce data privacy and IP protections.

What are the risks of misclassifying remote sales workers?

- Misclassifying remote workers as independent contractors can result in legal disputes, tax penalties, and company culture and engagement damage.